-

By LIjo James

-

November 1, 2025

- 0 Comment

Why Having a Bill Matters When Selling Gold in India

LIjo James

Lijo James – Internal Auditor & Gold Appraiser With over 10 years of experience, Lijo James is a seasoned Internal Auditor and Gold Appraiser specializing in the gold market. His expertise lies in conducting detailed gold market studies, ensuring accurate appraisals, and implementing robust auditing practices. Lijo’s in-depth knowledge of gold trends and market dynamics enables him to deliver reliable insights and maintain high standards of financial accountability. Dedicated to precision and integrity, he consistently ensures compliance with industry regulations while optimizing processes. His commitment to excellence makes him a trusted professional in the gold appraisal and auditing sector.

Read full bio of LIjo JamesSelling your gold can feel overwhelming — especially when you realize you’ve misplaced the original purchase bill. Maybe the jewelry was bought years ago, gifted by family, or passed down through generations. Now that you want to sell it, that missing piece of paper suddenly raises a dozen questions: Will buyers trust me? Will I still get a fair price? Could it even be illegal to sell without a bill?

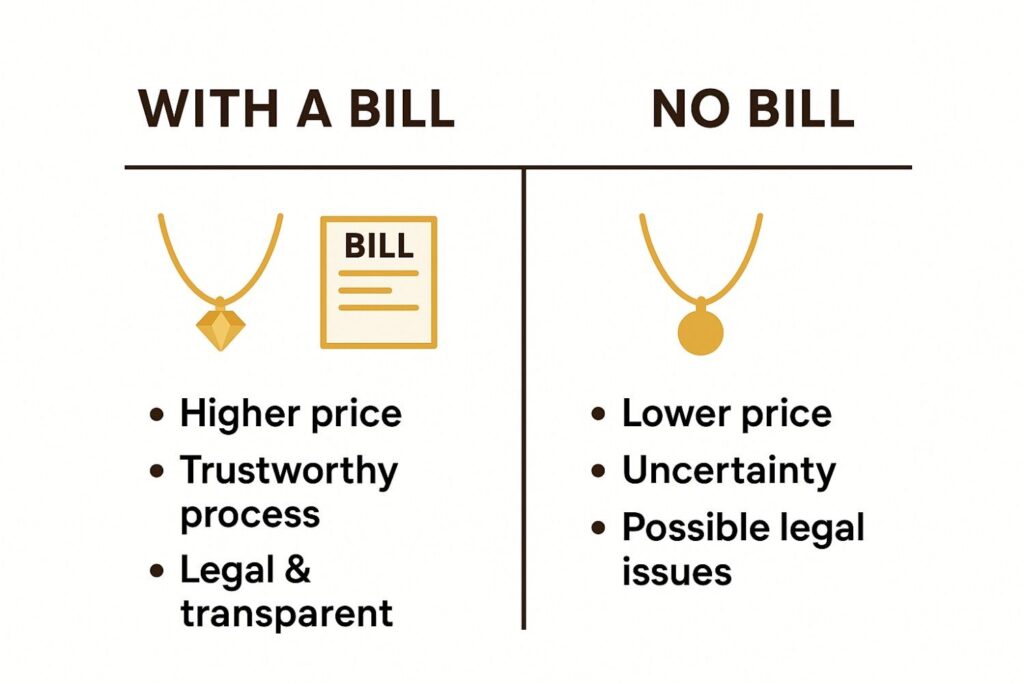

The truth is, you can sell gold without a bill — it’s perfectly legal in India — but having one makes the entire process easier, safer, and more transparent. A bill acts like a shield: it proves ownership, builds buyer confidence, and ensures you get the value your gold truly deserves.

What Is a Gold Bill?

A gold bill (also called an invoice or receipt) is an official record of your gold purchase or sale. It includes key details like:

- Seller and buyer information

- Weight and purity of gold

- Gold rate per gram and any deductions

- Final price paid

- Date, time, and signature or seal

This small piece of paper is your proof of ownership and transparency. It protects both the seller and the buyer.

What the Law Says About Selling Gold in India

Before you walk into any gold buyer’s office, it’s worth knowing what the law says about gold transactions in India. Following these simple rules can save you from legal or financial headaches later.

When selling gold in India, a few simple legal steps can help you stay safe and compliant.

- KYC verification (Aadhaar or PAN) is mandatory for any gold transaction worth over ₹2 lakh.

- Proper documentation protects both you and the buyer from misunderstandings, disputes, or fraud.

- Taxes and capital gains may apply if you’re selling large amounts or making a profit from old investments.

- Always ask for a bill—it keeps your sale traceable, transparent, and legally sound in case questions arise later.

What If You Don’t Have a Bill?

It’s still possible to sell gold without a bill — but you’ll need extra verification.

Here’s what typically happens:

- Provide valid ID proof like Aadhaar, PAN, or Passport.

- Some buyers may offer a slightly lower rate since they can’t confirm the source.

- Reputed buyers may still accept, but they’ll test purity in your presence.

So, while selling without a bill is legal, it’s not ideal if you want top value and minimal hassle. Reputed gold buyers in India may still complete the transaction legally, provided all KYC norms and purity checks are satisfied.

Why Having a Bill Works in Your Favour

- Proof of Ownership — Your bill shows the gold legally belongs to you — useful in any dispute or audit.

- Transparent Valuation — It lists purity, weight, and gold rate — ensuring no hidden deductions.

- Fair Price & Better Negotiation — A bill lets you compare rates confidently and question unfair offers.

- Smooth Resale — Buyers trust documented gold, so resale becomes faster and easier.

- Tax & Accounting Record — Useful for investors or anyone declaring capital gains.

What Should a Proper Gold Bill Include?

Element | Why It Matters |

Seller & Buyer Name/Address | Establishes identity and traceability |

Date & Time | Marks the transaction for record-keeping |

Item Details (weight, purity, hallmark) | Confirms authenticity |

Gold Rate & Formula Used | Ensures accurate value |

Deductions (testing, melting) | Guarantees transparency |

Final Amount Paid | Confirms payment |

Buyer’s License / GST / Signature | Verifies legitimacy |

Copy for Seller | Serves as your personal record |

Risks of Selling Gold Without a Bill

- Buyers may undervalue your gold: Without a bill, buyers may assume the gold lacks proper verification or authenticity, which could lead them to offer a lower price than its true market value.

- No proof if a dispute arises: If any disagreement occurs regarding weight, purity, or payment, you have no official document to support your claim, leaving you vulnerable.

- Higher-value sales may attract compliance scrutiny: Large transactions without proper documentation may trigger questions from banks or authorities under KYC or tax regulations, slowing or complicating the sale.

- Harder to prove capital gains or source of funds later: Without a bill, it becomes difficult to demonstrate the original purchase price or source of the gold for tax purposes, potentially leading to higher taxes or legal issues.

👉 In short: no bill = no protection: Essentially, selling gold without a bill removes your legal and financial safeguards, exposing you to undervaluation, disputes, and compliance risks.

💡 Expert Tips

- Verify Purity First – Always check the karat or hallmark; it ensures you get the right value.

- Compare Rates – Check current gold prices across multiple trusted buyers before selling.

- Ask for a Bill – Even small sales are safer with proper invoices for future proof.

- Keep KYC Ready – Aadhaar or PAN may be required for higher-value transactions; having them ready speeds up the process.

- Avoid Unknown Buyers – Selling to unknown or unverified shops can lead to disputes or undervaluation.

- Time Your Sale – Monitor market trends; selling when prices peak can maximize your return.

- Document Everything – Photos, weight slips, and test reports add extra layers of protection.

Tips Before You Sell Your Gold

- Always ask for a computerized bill: even for small transactions: A computerized bill ensures a verifiable, legal record of your sale, protecting you from future disputes regardless of the transaction size.

- Carry valid ID proof (Aadhaar, PAN, Passport): This is a mandatory legal requirement for all gold transactions, confirming your identity and establishing the sale’s legitimacy.

- Watch the purity test happen in front of you: Observing the purity test ensures the exact karat value of your gold is determined accurately and transparently, preventing any unfair lowball offers.

- Confirm the rate per gram and deductions before agreeing: Always finalize the current gold rate and clearly understand any charges or deductions to guarantee you receive the maximum correct value for your gold.

- Choose licensed, certified buyers like IMG Gold Buyers for fair and transparent pricing: Selecting a certified buyer ensures you deal with a reputable business that follows ethical practices and offers fair, trustworthy valuations trusted among gold buyers in India.

FAQs

Is it necessary to have a bill when selling gold in India?

Can I sell gold without a bill?

What documents are required to sell gold legally in India?

To sell gold legally, you typically need:

- A government-issued photo ID (e.g., Aadhaar, PAN, Passport)

- Address proof (e.g., utility bill, bank statement)

- Original purchase invoice or bill (if available)

- Release letter or No Objection Certificate (NOC) if the gold was pledged.

Does not having a bill affect the price I get for my gold?

Yes, lacking a bill can lead to a lower valuation. Without it, buyers may apply a discount to account for potential risks, such as verifying the gold’s authenticity and purity.

Is it legal to sell gold without a bill in India?

Yes, it’s legal to sell gold without a bill. However, providing a bill can facilitate a smoother transaction and ensure you receive a fair price.

What happens if I sell gold without a bill?

Selling gold without a bill may lead to:

- Lower offers from buyers

- Additional documentation requirements

- Potential delays in the selling process

- Increased scrutiny from authorities to prevent illegal transactions.

Can I sell inherited gold without a bill?

Do I need a bill to sell gold at a pawnshop?

What if I lost the bill for my gold purchase?

How can I ensure I get a fair price for my gold?

- Obtain a purchase bill if possible

- Ensure the gold is hallmarked

- Compare offers from multiple buyers

- Choose reputable buyers with transparent processes.

Conclusion

Selling gold should always be a secure, transparent, and hassle-free experience. A bill is not just a piece of paper — it acts as your protection, ensuring fair pricing, legal compliance, and trust between you and the gold buyer. Without proper documentation, you risk undervaluation, disputes, or complications in future transactions.

At IMG Gold Buyers, we go beyond mere transactions: every customer receives a computerized invoice, accurate and transparent purity testing, and instant payment, giving you complete clarity and confidence. With us, selling your gold becomes not only safe but truly rewarding, allowing you peace of mind every step of the way.

Written by LIjo James