-

By LIjo James

-

November 1, 2025

- 0 Comment

2025 Gold Seller’s Handbook: Secure, Transparent, and Profitable Selling

LIjo James

Lijo James – Internal Auditor & Gold Appraiser With over 10 years of experience, Lijo James is a seasoned Internal Auditor and Gold Appraiser specializing in the gold market. His expertise lies in conducting detailed gold market studies, ensuring accurate appraisals, and implementing robust auditing practices. Lijo’s in-depth knowledge of gold trends and market dynamics enables him to deliver reliable insights and maintain high standards of financial accountability. Dedicated to precision and integrity, he consistently ensures compliance with industry regulations while optimizing processes. His commitment to excellence makes him a trusted professional in the gold appraisal and auditing sector.

Read full bio of LIjo JamesWhy Selling Gold Feels Complicated (and How to Simplify It)

If you’ve ever tried to sell gold jewellery, you probably know the uneasy feeling that comes with it.

Am I getting the right price? Is the buyer honest? Should I wait for gold prices to rise?

In 2025, gold prices are soaring — partly due to inflation, currency fluctuations, and global uncertainty. That makes this year an excellent time to consider selling. But with opportunity comes risk: not every buyer will offer a fair rate, and many sellers lose value simply because they don’t understand how gold pricing really works.

If you’ve been searching online for who buys jewelry for cash near me, this guide will help you identify trustworthy gold buyers and simplify the process — so you sell confidently, safely, and for the best possible value in Bangalore’s vibrant gold market.

Understand the Gold Market in 2025

Before you walk into a gold buyer’s store or check today’s gold rate online, it’s important to understand what’s behind those daily price updates. Gold prices don’t move randomly — they’re influenced by global markets, currency strength, and even local jewellery demand. Knowing these factors helps you sell at the right time and at the right value.

- Global Gold Prices Are Near Record Highs: Gold is considered a safe-haven asset, which means investors turn to it when the economy feels uncertain. In 2025, international gold prices remain elevated, driven by a mix of global inflation, geopolitical tensions, and continuous central bank buying. When large institutions and governments buy and hold gold, it reduces supply in the open market — keeping prices high. When global prices rise, the base value of your gold increases too. So, even old jewellery sitting in your locker could now fetch a much higher return compared to a few years ago.

- Rupee Fluctuations Impact Local Gold Prices: Gold is traded internationally in U.S. dollars, so any change in the rupee–dollar exchange rate directly affects what Indian sellers receive. When the Indian rupee weakens against the dollar, it costs more rupees to buy the same amount of gold — making local gold prices go up even if global prices stay stable.

- Local Demand Adds a Premium: In India, gold isn’t just an investment — it’s an emotion tied to festivals, weddings, and family occasions. Because of this, local demand plays a big role in determining gold rates across cities. During festive or wedding seasons, jewellery shops and gold buyers often experience high demand, leading to slight price premiums in major cities. Making charges and regional hallmarking or purity norms vary by city and jeweller, leading to slight differences in your final offer price.

Evaluate Your Gold: Know What You’re Selling

Before you step into a gold buyer’s office, it’s essential to understand exactly what your gold is worth. The price you receive depends on several factors — purity, weight, condition, and current market rates. By knowing these details, you can confidently negotiate and ensure you’re getting a fair and transparent deal.

- Purity (Karat Value)

Gold purity is measured in karats (K), which indicate how much of the piece is pure gold versus other metals.- 24K gold is 99.9% pure and typically found in coins or bars.

- 22K gold is about 91.6% pure and is the most common type used in Indian jewellery.

- 18K or 14K gold contains a mix of gold and other metals like copper or silver, commonly used in designer or modern jewellery.

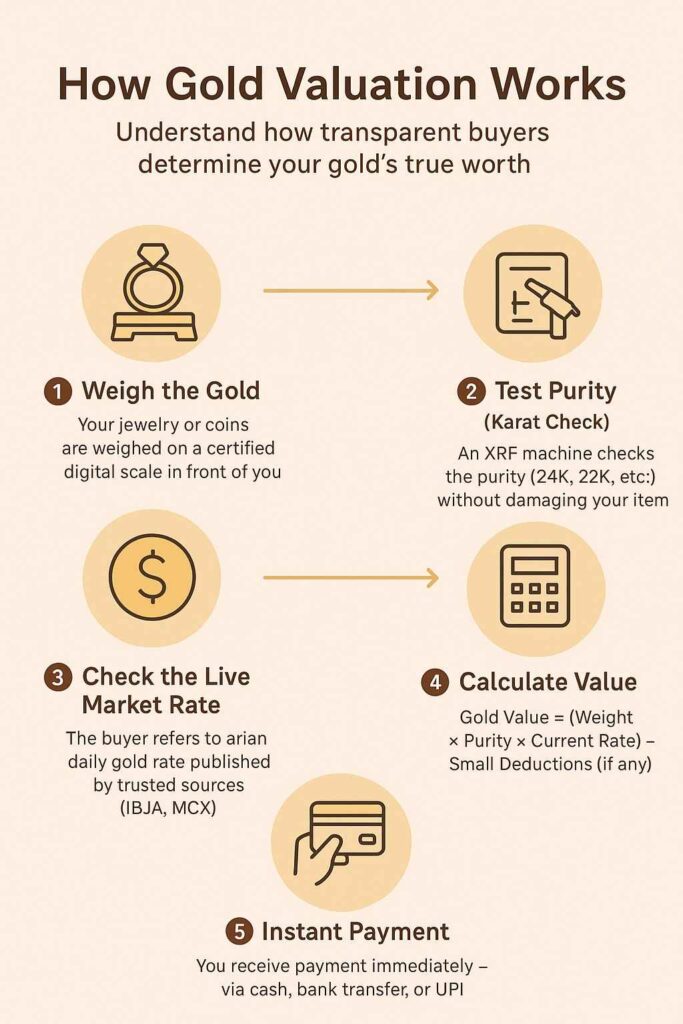

Always ask for an XRF purity test, which is non-destructive and gives precise results. Reputable gold buyers in Bangalore — like IMG Gold Buyers — conduct this test right in front of you, ensuring complete transparency.

- Weight

Weight plays a crucial role in determining your gold’s melt value. Always make sure your item is weighed in front of you using a calibrated electronic scale to avoid discrepancies. Note down the exact weight in grams — this figure becomes the foundation for calculating the offer you receive based on the current gold rate. - Design & Condition

Your jewellery’s design and overall quality can also influence its value. Designer, antique, or branded pieces may fetch a slightly higher price if buyers consider their resale or aesthetic appeal. However, broken or damaged jewellery is usually valued only for its gold content (melt value), without any premium for design or craftsmanship. - Current Market Rate

Before selling, always check the live gold rate for both 22K and 24K purity to know the true market value of your jewellery. Reliable sources like the India Bullion and Jewellers Association (IBJA) website or local jeweller rate boards in Bangalore display updated prices daily. This simple step helps you spot fair offers and avoid buyers who quote below-market rates. - Documentation

Carry any purchase receipts, hallmark certificates, or previous appraisals when selling your gold. These documents act as proof of authenticity and purity, helping buyers evaluate your jewellery more quickly and confidently. Proper paperwork also strengthens your position during negotiation and reduces the chances of disputes or undervaluation.

Choose the Right Time to Sell

Once you understand your gold’s value, the next step is to decide when to sell for the best return. Selling gold isn’t just about finding the highest rate — it’s also about choosing the right moment. Timing can greatly influence how much value you receive, especially when markets are volatile or trending high. In 2025, with gold prices at record levels, even small shifts in timing can make a noticeable difference. Beyond market charts, your personal circumstances and local demand cycles also play key roles. Understanding when and why to sell ensures you make a confident, well-timed decision that maximizes both value and peace of mind.

- Market Timing:

Gold prices move with global economic trends, inflation, and investor confidence. When prices are high, like in 2025, selling part of your gold holdings can be wise — but avoid waiting endlessly for the “highest peak,” which is unpredictable. Minor daily changes shouldn’t worry you if the long-term price direction is favorable. - Personal Timing:

Your personal needs and financial goals should guide your decision just as much as market rates. If selling gold helps clear high-interest debt or fund important milestones like education or business investment, the emotional peace and financial benefit are worth more than chasing an extra few hundred rupees per gram. Timing your sale around your life’s priorities ensures it’s a meaningful and smart move. - Local Factors:

In cities like Bangalore, cultural and seasonal events can influence gold demand and buyer activity. During festivals such as Akshaya Tritiya or Dhanteras, gold buyers in Bangalore and jewellers often offer slightly better rates or faster evaluations to attract sellers. Staying aware of these local cycles helps you pick moments when offers are competitive and market sentiment is high.

How to Choose a Trusted Gold Buyer in Bangalore

Selling your gold is a big decision — and the person you sell it to matters just as much as the price you get. In a busy market like Bangalore, dozens of buyers promise the “best rate,” but not all operate with the same honesty or transparency. Choosing the right buyer protects you from unfair deductions, fake promises, or hidden charges. The key is to know what signs to look for — and what warning signals to avoid. Here’s how to confidently find a trusted gold buyer who values both your gold and your trust.

✅ Look for These Qualities:

- Licensed & Certified: A genuine gold buyer will have a valid government license or certification displayed in their office. This shows they follow proper rules and are accountable for fair business practices. Always ask to see their registration before starting the evaluation.

- Transparent Testing: Trustworthy buyers test your gold right in front of you using modern machines like XRF testers. This way, you can clearly see the purity result and ensure there’s no swapping or tampering. Open testing builds confidence and removes all doubts about honesty.

- Clear Rate Display: Reputed buyers display the daily gold rate on a digital board or screen. They’ll also explain how the final value is calculated based on purity, weight, and market rate — so you know exactly how much you’re getting and why.

- Instant Payment: The best buyers pay you immediately once the valuation is complete. Whether it’s cash, bank transfer, or UPI, there should be no delays, hidden charges, or excuses. Quick payment is a key sign of professionalism and reliability.

🚩 Avoid These Red Flags:

- Vague Pricing (“Depends on Condition”): If a buyer avoids giving a clear rate or says “it depends,” be cautious. It’s a common trick to underpay sellers once the deal starts. Always insist on a proper written rate or printed quote.

- Testing in a Back Room: Never allow your jewelry to be taken into another room for testing. Honest buyers always evaluate in front of you. If they don’t, it’s a sign of poor transparency.

- Hidden Service Charges: Some dealers deduct “testing fees” or “handling charges” after evaluation. Ask in advance about all possible deductions to avoid surprises and unfair reductions in your payment.

- Unrealistically High Initial Quotes: If an offer sounds too good to be true, it usually is. Some buyers lure customers with inflated quotes, then reduce the rate after testing. Trust only those who keep their word and match their initial quote.

Pro Tip

Visit at least two to three buyers before deciding. The best deal often comes from comparison, not the first offer.

Common Mistakes That Reduce Your Gold’s Value

Even seasoned sellers can unknowingly lose money when selling their gold. A small oversight — like skipping a purity test or rushing into a deal — can make a significant difference in the final payout. To make sure you get the maximum value for your gold in 2025, avoid these common mistakes that many sellers still make.

- Not Knowing the Purity: One of the biggest mistakes sellers make is assuming the karat value of their jewellery without verification. Many people believe their jewellery is 22K, only to find out during testing that it’s 18K or even 14K — which means less pure gold and a lower price. Always insist on an XRF purity test before selling; it’s quick, non-destructive, and ensures that you’re paid exactly for the purity you own.

- Selling in a Hurry: Selling gold out of urgency — whether due to financial need or emotional stress — often leads to accepting the first offer you receive. Quick decisions usually mean you don’t have time to compare prices or understand deductions. Take a day or two to get at least three quotes from reputed buyers; this small effort can earn you a noticeably higher return.

- Skipping Documentation: Missing or misplaced purchase bills, hallmark certificates, or appraisals can cause buyers to undervalue your gold. Documentation helps prove the authenticity and purity of your jewellery, reducing any doubt in the buyer’s mind. Even if you don’t have the original bill, you can still get your gold retested and hallmarked, which adds credibility and ensures fair valuation.

- Ignoring Hidden Deductions: Many sellers overlook deductions such as melting charges, stone removal costs, or testing fees, which reduce the final payout. Some buyers may also apply small percentage cuts for wastage or impurities. To protect your value, always ask for a written breakdown that includes purity, weight, current market rate, and any deductions before agreeing to the price.

- Trusting Unverified Buyers: In a rush to sell, people sometimes turn to unverified buyers, online ads, or doorstep services with no physical address or business registration. These options often promise “instant cash” but may offer unfair rates or involve hidden risks. Always choose a licensed, transparent gold buyer with a physical office, testing done in front of you, and clear transaction documentation.

What “Best Value” Really Means While Selling Gold

Many gold sellers believe “best value” means getting the retail price they once paid — but that’s a common misconception. The truth is, when you sell gold, buyers don’t pay based on retail jewellery prices (which include making charges, design premiums, and brand markups). Instead, they calculate your offer based on the pure gold content, minus minor deductions for refining, melting, and resale.

- Understand What You’re Really Paid For: Gold buyers pay for the actual gold content, not for the design, brand, or emotional value of your jewellery. The valuation is derived from the live market (spot) rate for 24K gold and then adjusted based on your gold’s purity (e.g., 22K, 18K, or 14K). After testing and confirming purity, small deductions are applied to cover refining or testing costs — this is completely normal and standard across the industry.

-

The Realistic Payout Range:

When selling gold jewellery, you can typically expect to receive 60% to 90% of the live 24K spot rate, depending on:

- Purity: Higher karat means higher payout.

- Design: Simple, plain pieces often fetch more than complex ones with stones.

- Condition: Broken or worn jewellery is usually valued for its melt content only.

-

Focus on Transparency, Not Just the Rate:

The best value isn’t always the highest quote — it’s the most transparent process. A trustworthy gold buyer will:

- Test your gold’s purity in front of you using an XRF machine.

- Show your jewellery’s exact weight on a calibrated scale.

- Clearly explain the rate used, purity percentage, and all deductions before finalizing the payment.

Conclusion: Selling Gold Can Be a Smart, Stress-Free Decision

Selling your gold doesn’t have to be confusing or stressful — it can be a smart financial move when you understand how the process works and choose the right buyer. Whether you’re parting with old jewellery, coins, or broken pieces, knowledge is your biggest advantage.

✅ Know your gold: Understand purity, weight, and current market rates before you sell.

✅ Compare offers: Don’t settle for the first quote; check multiple buyers to find who offers fair, transparent pricing.

✅ Trust transparency: The best gold buyers test your items in front of you, explain every step, and ensure you get what your gold is truly worth.

When you take these steps, selling gold in Bangalore becomes quick, fair, and rewarding — giving you not just cash, but confidence in every transaction.

At IMG Gold Buyers, every piece is tested right before your eyes, with live rate updates and instant payment — no hidden deductions, no uncertainty. You walk away knowing you’ve received the true value of your gold, backed by professionalism and trust.

✨ Ready to get your gold evaluated?

Visit your nearest IMG Gold Buyers branch in Bangalore or schedule a free purity check today — and experience a gold-selling process built on honesty, clarity, and confidence.

FAQs

What should I realistically expect to get when selling gold jewellery?

“Most places that buy gold, including jewellery stores, will pay 50%-80% of the spot price based on the amount of gold in the pieces you are selling.” That means you shouldn’t assume you’ll get full market price. Because of purity differences, making-charges, design, stones, and buyer margin, many sellers get well under the “pure gold value”.

How do I know I’m choosing a good place to sell?

“Find a bullion shop or someone that sells jewellery or gold, don’t go to a pawn shop and make sure you call around see what you can come up with before you go.”

So it helps to:

- Call ahead, ask what they pay, and get multiple quotes.

- Avoid places that lack transparency or try to rush you.

- Prefer buyers who test the gold in front of you, show rates clearly, and explain deductions.

Will I get “spot price” for my gold?

“Is it safe to assume that I will be getting spot price for the gold?” — one user asked.

Short answer: No, not usually. Many factors reduce payout: the karat/purity of the piece, condition, design, presence of stones, the buyer’s margin, and local demand. Knowing the “spot” or live gold rate is important — but you’ll typically receive a percentage of that after adjustments.

How important is purity (karat/hallmark) and weight when selling?

Very important. Buyers evaluate the actual content of gold inside a piece.

For example: “You can sell it to a refinery and they will let you know how much they will pay you according to the gold content since most gold is not 24 k.”

The higher the purity (e.g., 22 k, 24 k) and the more accurate the weight, the closer you can get to fair value. Lower karats (14 k, 10 k) or mixed materials/designs often reduce the payout.

Do I need to worry about taxes when I sell my gold?

Yes, tax considerations matter — especially depending on your country and whether you’re selling coins, bullion or jewellery. For example, one FAQ notes that bullion may be treated differently for tax than jewellery.

In India, for instance, capital gains from selling gold are subject to tax depending on the holding period. So it’s wise to:

- Keep purchase/ownership records.

- Ask the buyer for a proper receipt.

Understand your local tax laws before selling.

Can selling large amounts of gold become difficult or take more time?

Yes. From Reddit: “As gold prices have held over $2,000/oz., I’ve found larger gold (≥20 oz etc) takes a little longer to sell now and premiums have compressed.”

So if you’re selling a big chunk (coins, bars, high-value jewellery), you might need to allow more time, shop around more carefully, and possibly deal with more paperwork or verification.

Should I just walk into the first buyer and accept an offer?

“Call a few local stores and ask them what they would pay … then go to the one with the best quote.”

No — it’s better to visit at least 2-3 buyers. Comparison gives you a benchmark, helps you spot low offers, and improves your negotiating position.

Written by LIjo James