-

By LIjo James

-

November 1, 2025

- 0 Comment

Top Tips to Identify Genuine Gold Buyers

LIjo James

Lijo James – Internal Auditor & Gold Appraiser With over 10 years of experience, Lijo James is a seasoned Internal Auditor and Gold Appraiser specializing in the gold market. His expertise lies in conducting detailed gold market studies, ensuring accurate appraisals, and implementing robust auditing practices. Lijo’s in-depth knowledge of gold trends and market dynamics enables him to deliver reliable insights and maintain high standards of financial accountability. Dedicated to precision and integrity, he consistently ensures compliance with industry regulations while optimizing processes. His commitment to excellence makes him a trusted professional in the gold appraisal and auditing sector.

Read full bio of LIjo JamesSelling gold isn’t just about money — it’s often about memories. Every ring, chain, or bangle tells a story, and parting with it can feel deeply personal. That’s why when you decide to turn your gold into cash, trust and transparency matter more than anything else.

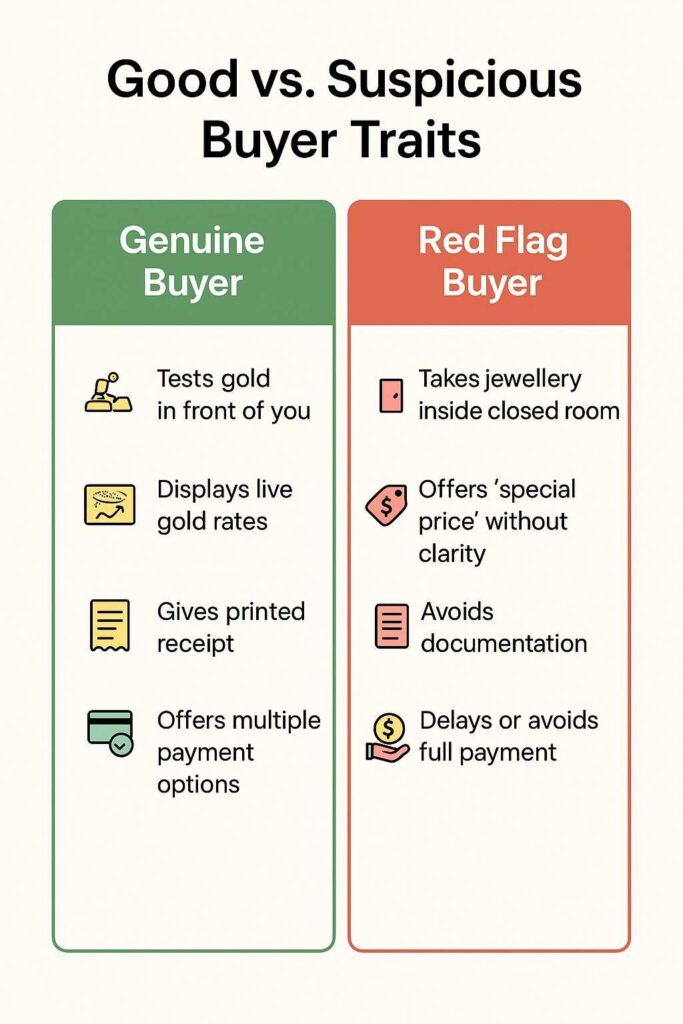

But here’s the challenge — with so many gold buyers in Bangalore claiming to offer the “best price,” how do you know who’s truly genuine? It’s easy to be drawn in by flashy ads or confusing promises. Some buyers test your gold behind closed doors or add hidden deductions, leaving you unsure whether you got a fair deal.

This guide helps you spot trusted, verified gold buyers through real customer reviews, fair evaluation practices, and clear, open processes — so you can sell your gold confidently and get the true value it deserves.

Why Genuine Reviews Matter

When you search “best gold buyers near me”, reviews are your reality check. Real customer feedback reveals what advertisements don’t — how fairly the gold was tested, how quickly the payment was made, and whether the customer felt respected during the process.

👉 Look for patterns, not perfection.

A few negative reviews are natural, but repeated complaints about hidden charges, delayed payments, or unclear testing are red flags.

“I sold my bangles here — they showed the purity test live and transferred the amount within 10 minutes!” — Verified Google Review

Check Reputation & Authenticity

When selling gold, trust is the most important factor — and it starts with visibility and credibility. A genuine gold buyer in Bangalore demonstrates transparency, accountability, and experience. Before you hand over your precious items, look for clear signs that show the buyer values reputation over quick profit. The following points highlight what to check to ensure your gold is in safe hands:

-

Registered Physical Store or Office

A trustworthy gold buyer should have a verifiable physical presence. Avoid dealing with buyers who only exist online, as this increases the risk of scams or fake operations. A physical store ensures accountability and legal compliance. -

Consistent Google Reviews

Check online reviews to see how past customers describe their experience. Genuine reviews often mention transparent procedures, live purity testing, and fair pricing. Consistency across reviews indicates reliability rather than a few paid or fake testimonials. -

Several Years of Operation

Experience matters in gold buying because seasoned buyers prioritize reputation over short-term profit. Long-standing businesses are more likely to follow ethical practices. This reduces the chance of hidden deductions or unfair evaluations.

Verify the Evaluation Process

Trust starts with transparency, and the way your gold is evaluated is a key indicator of a buyer’s credibility. Reviewers often highlight this as the most important aspect of a trustworthy gold transaction. Whether you’re comparing different buyers or simply figuring out where to sell gold jewellery for cash with confidence, these checkpoints ensure your gold is valued fairly and honestly.

- Test in Your Presence

A genuine buyer will test your gold using XRF (X-Ray Fluorescence) machines or karat-check devices right in front of you. This ensures that the purity measurement is accurate and prevents any manipulation. - Use Certified Electronic Weighing Scales

Accurate weight is crucial for determining the correct price of your gold. Certified electronic scales guarantee precision and eliminate disputes over underweight claims. - Explain Each Step Clearly

The buyer should clearly explain how purity is checked, any deductions for stones or impurities, and the final valuation. Transparency at each step builds trust and helps you understand exactly what you are being paid for. - Avoid Hidden Testing

Stay away from buyers who test gold behind closed doors or tell you, “We’ll let you know the value later.” Such practices hide the process and increase the risk of unfair valuation or lowball offers.

Compare Multiple Offers

Selling gold is just like selling your car — you wouldn’t accept the first quote you get, right? Gold buyers often differ in the rates they offer, testing methods they use, and how transparent they are about charges. Taking time to compare even two or three buyers can make a big difference in what you finally receive.

Here’s what to check before you decide:

- Are they using today’s IBJA live rate?

A trustworthy buyer always follows the Indian Bullion and Jewellers Association (IBJA) rate of the day. This ensures you’re getting a fair market value for your gold rather than an outdated or manipulated rate. - Are there hidden service charges?

Some buyers deduct melting, testing, or handling fees quietly. Always ask for a complete breakup before you hand over your gold — honest buyers are upfront about every rupee. - Do they offer instant cash or transfer?

Genuine buyers settle payments on the spot, either in cash, UPI, or direct bank transfer. Delayed payments can indicate liquidity issues or unprofessional practices.

Ask About Payment & Documentation

The moment your gold is tested and priced, your next focus should be on how you get paid and what proof you receive. Reliable gold buyers are transparent — they explain every step and document every transaction properly.

Look for these key signs of professionalism:

-

Instant payment (cash, UPI, or bank transfer):

A reputable buyer won’t make you wait. Payment happens immediately after valuation, ensuring there’s no room for confusion or false promises. -

Computerized invoice with purity, weight, and final amount:

Your invoice is the backbone of the deal. It should include your gold’s purity, total weight, rate per gram, and the final settlement amount — all neatly printed and verifiable. Your bill is your proof. It’s what safeguards your transaction — and it’s something trusted names like IMG Gold Buyers provide with every sale. -

No vague promises like “come back tomorrow”:

Genuine dealers don’t delay payments or paperwork. Any postponement or unclear explanation is a red flag.

Spot and Avoid Scams

With online gold-buying ads everywhere, scams have become more creative — from fake websites to doorstep pickup traps. Staying alert can save you from serious loss or theft. Only deal in person or through verified representatives. Transparency and traceability are your best protection.

Common scam red flags include:

-

Unrealistic claims like “110% of market price”:

No buyer can legitimately offer above the gold market rate. Such claims are meant to lure unsuspecting sellers. -

Requests to send gold by courier:

Always refuse. Once your gold leaves your possession, recovering it is almost impossible if the buyer turns out to be fake. -

Fake websites copying reputed brand names:

Scammers often clone the logos and names of trusted companies. Always cross-check the official GST number, company name, and phone number before proceeding.

Check Legal Compliance & Licensing

If a buyer avoids paperwork, hesitates to issue a receipt, or downplays legal formalities — that’s your cue to walk away immediately. Any professional gold buyer in Bangalore must operate under proper licensing and legal norms. These certifications protect you and ensure ethical practices.

Here’s what every legitimate buyer must have:

-

Valid trade license and GST registration:

This proves that the business operates legally and is accountable to government regulations. -

Printed receipt for every transaction:

Never accept handwritten notes or verbal confirmations. A printed bill confirms that your transaction is recorded and traceable. -

KYC process (ID proof mandatory):

KYC isn’t just formality — it’s a legal requirement to prevent fraud. Handing over a photocopy of your ID is part of standard compliance.

Learn from Real Customer Experiences

Before choosing where to sell, listen to those who’ve already been there. Customer reviews reveal how a company treats its clients — not just how well they advertise.

Positive review signs:

- The gold testing is done live, right in front of the customer.

- Payment is processed instantly without excuses.

- Staff are polite, respectful, and informative.

- The valuation process is explained clearly and patiently.

Warning signs in reviews:

- Complaints about delayed or partial payments.

- Deductions that aren’t properly explained.

- Rude or dismissive behavior from staff.

Try searching phrases like “My experience selling gold in Bangalore” or “Gold buyer near me honest review.” You’ll notice that the same few trustworthy names appear over and over again — those are the ones worth visiting.

Conclusion: Choose Transparency Over Temptation

Selling gold doesn’t have to feel stressful or risky — the key is knowing what to look for. Tempting offers from unknown or unverified buyers may seem convenient but can lead to unfair payouts or hidden deductions.

By checking genuine reviews, you get insight into other customers’ experiences and can spot trustworthy buyers. Verifying evaluation methods, like testing gold in your presence with certified machines, ensures that the purity and weight are measured accurately. Ensuring fair and instant payment protects you from lowball offers or delayed transactions.

✨ Smart Tip:

Always prefer gold buying companies who test gold openly, display live gold rates, and pay instantly without deductions. This combination of transparency, fairness, and professionalism is how you can confidently identify genuine experts, such as IMG Gold Buyers, who respect both your gold and your trust.

FAQs: Selling Gold in Bangalore

What price should I expect when selling gold jewellery?

“I had a 14k necklace… they gave me 40% of 14k spot for it. Is that normal?”

Many users report that jewellery—especially lower purity or heavily worn pieces—gets priced well under the current spot rate. Always ask for the rate per gram, purity, and how much the buyer deducts for making charges or wear-and-tear.

Will I get the full “spot price” for my gold?

“Is it safe to assume that I will be getting spot price for the gold? What % should I expect to pay in taxes on the sold gold?” reddit.com

The short answer: rarely. Dealers often offer a rate below the live spot to cover their own costs and margins. Make sure you understand how much below spot you’re being offered and why.

How do I find a trustworthy buyer and get the best offer?

Are there extra risks when selling large amounts of gold (say bars or coins)?

“Larger gold … takes a little longer to sell now and premiums have compressed.” reddit.com

Yes — with bars or high-volume gold, liquidity can be lower and fewer buyers may offer full rates. Ensure the buyer has the capacity, transparency, and immediate payment ready.

What red flags should I watch out for in a gold-buying deal?

“Some changed the price after receiving the items.”

reddit.com

Red flags include: drastically lower offer than initial quote, requests to send gold first, no live testing in front of you, vague deductions. Always insist on seeing the process and getting clear documentation.

Written by LIjo James