-

By LIjo James

-

September 28, 2025

- 0 Comment

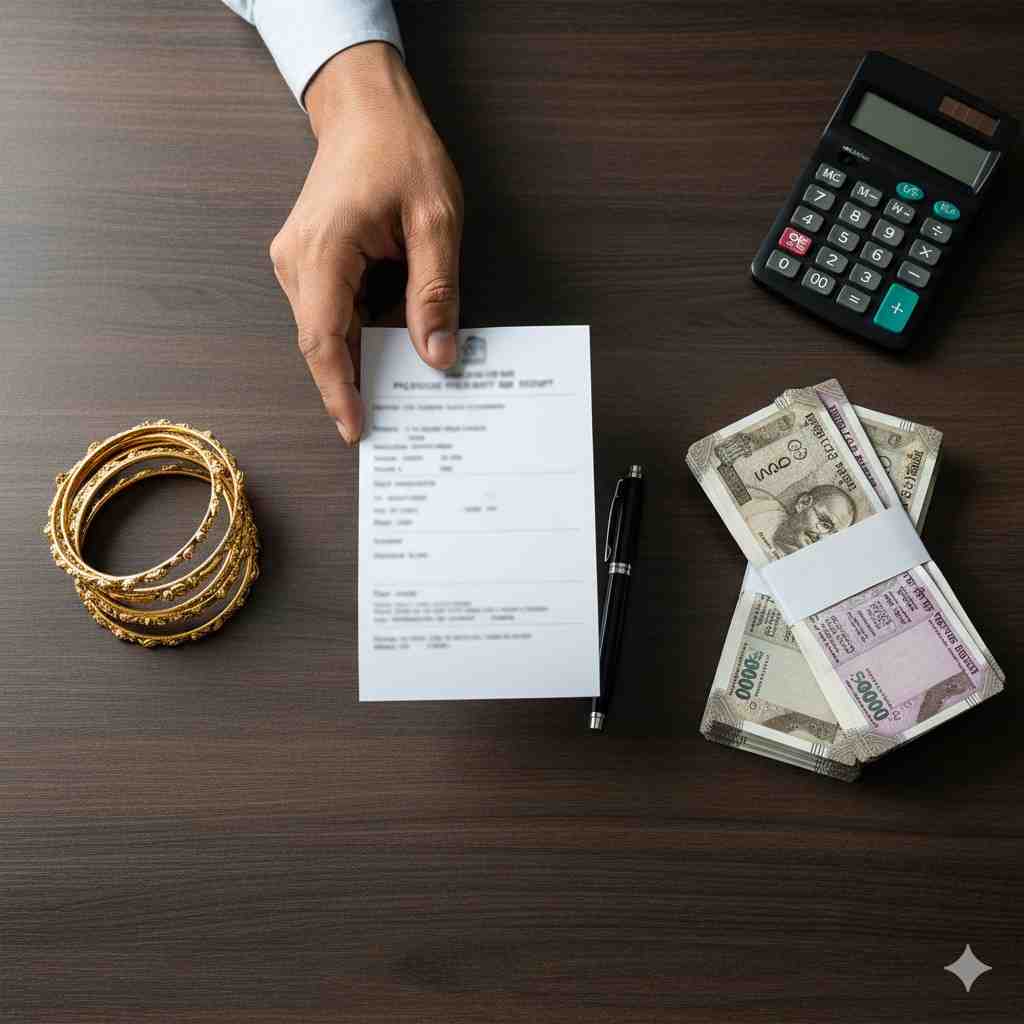

Step-by-Step Guide to Releasing and Selling Pledged Gold in Bangalore

LIjo James

Lijo James – Internal Auditor & Gold Appraiser With over 10 years of experience, Lijo James is a seasoned Internal Auditor and Gold Appraiser specializing in the gold market. His expertise lies in conducting detailed gold market studies, ensuring accurate appraisals, and implementing robust auditing practices. Lijo’s in-depth knowledge of gold trends and market dynamics enables him to deliver reliable insights and maintain high standards of financial accountability. Dedicated to precision and integrity, he consistently ensures compliance with industry regulations while optimizing processes. His commitment to excellence makes him a trusted professional in the gold appraisal and auditing sector.

Read full bio of LIjo JamesGold is often pledged during financial emergencies. It gives you quick access to money, but once the crisis is over, many people want to release or sell their pledged gold. That’s when doubts start:

- Will I get the right value?

- Do I have to deal with hidden fees?

- Which place in Bangalore is actually safe and trustworthy?

If you’ve asked yourself these questions, you’re not alone. Selling pledged gold can feel overwhelming, but with the right information, it becomes a smooth and safe process. This blog will walk you through the Best Places to Sell Your Pledged Gold in Bangalore, what to watch out for, and how to make sure you get the best deal without stress.

Why People Sell Their Pledged Gold

Everyone’s reason is different, but the need is always urgent. Here are some common situations:

- Clearing debts: Many pledge gold for loans, but when interest piles up, selling becomes a better option.

- Family needs: Education, weddings, or medical bills often push people to release gold and convert it into cash.

- Business expenses: Small business owners sometimes use gold to secure funds and later sell it for working capital.

- Financial freedom: Some simply want peace of mind and prefer to clear obligations tied to their pledged gold.

Why Selling Pledged Gold Requires Extra Care

Selling regular gold jewelry is straightforward. But when your gold is pledged, there are a few extra steps:

- Loan repayment: You must clear the loan amount and any interest before the gold can be legally sold.

- Documentation: Carry the pledge receipt, identity proof (Aadhar, PAN, or Voter ID), and proof of ownership.

- Buyer transparency: Not every buyer in the market is genuine. Some may undervalue your gold or charge hidden fees.

⚠️ If these conditions are not met, you risk financial loss or even legal complications. That’s why choosing a safe, trusted place is essential.

What to Look for in a Trusted Buyer

When comparing options, focus on these five qualities:

- Reputation & Reviews

- Ask around in your community.

- Check Google reviews and testimonials.

- A well-reviewed buyer is less likely to cheat.

- Purity Testing Facilities

- Genuine buyers use X-ray fluorescence (XRF) or acid tests.

- Always watch the testing process—it should be done in front of you.

- Transparent Pricing

- The buyer should clearly state the per-gram rate.

- Ask about commissions, fees, or deductions before finalizing.

- Safe & Licensed Operations

- Ensure the buyer has a physical shop or branch in Bangalore.

- Licensed buyers provide receipts and follow regulations.

- Flexible Payment Options

- Whether you prefer cash, cheque, or bank transfer, a genuine buyer will offer safe choices.

Best Places to Sell Your Pledged Gold in Bangalore

Here are some of the Best Places to Sell Your Pledged Gold in Bangalore, each with its strengths and things to check:

| Place | Why It’s Good | What to Check |

|---|---|---|

| Reputed Local Jewellers | Familiar faces, good for bargaining, may guide you with paperwork. | Ensure they test gold with proper equipment and explain karat grading. |

| IMG Gold Buyers (Bangalore Branch) | Trusted name, helps with pledged-gold release, free valuation, instant settlements. | Confirm current gold rates and ask about their commission structure. |

| Banks / Finance Companies | If your gold is pledged here, you can repay dues and reclaim it directly. | Collect the pledge receipt and confirm no hidden penalties. |

| Gold Refineries / Bullion Dealers | Good for large amounts or bullion; often close to market rates. | Verify testing methods and avoid high service charges. |

| Online Platforms | Convenient; you can compare multiple offers without leaving home. | Only use verified, insured, and well-reviewed platforms. |

Tip: Don’t rely on just one option. Visit at least two to three buyers to compare offers before making a decision.

Step-by-Step: How the Selling Process Works

Here’s a simple way to approach it:

- Gather documents – pledge papers, ID proof, and receipts.

- Check gold rates – look up the current per-gram rate in Bangalore before you visit buyers.

- Get multiple quotes – don’t settle for the first offer. Compare jewellers, IMG Gold Buyers, and bullion dealers.

- Inspect the buyer – ensure they test gold in front of you and explain every deduction.

- Repay the loan – clear the pledge amount with the lender if required.

- Negotiate smartly – base discussions on purity, weight, and hallmarks.

- Finalize transaction – sign a receipt or agreement, collect payment, and keep proof of sale.

This method ensures you stay in control and don’t feel pressured into a poor deal.

Common Pitfalls to Avoid

Many sellers lose money because they make quick decisions. Avoid these mistakes:

- Accepting a Low Price Without Verifying Purity: Do not rush into a sale without understanding the true value of your gold. The price of gold is determined by its purity (karats) and its weight. Always insist that the buyer uses proper equipment, like an XRF machine, to test the gold’s purity in your presence. Be aware of the current market rate to ensure the offered price is fair.

- Selling to Unlicensed or Unverified Buyers: A common and risky mistake is dealing with buyers who lack a physical store or official license. These individuals may not be transparent with their testing or pricing. To ensure a secure transaction, always choose a reputable buyer with a registered business, a physical location, and positive customer reviews. A legitimate buyer will also require proper documentation for the sale.

- Overlooking Hidden Fees or Service Charges: Some buyers may quote a high price but then apply unexpected deductions for melting, testing, or other services. This can significantly reduce the final amount you receive. Before you agree to the sale, ask for a clear and detailed breakdown of all potential charges to avoid any surprises.

- Forgetting to Properly Close the Pledge Contract: This is a crucial step that many sellers overlook. Your first priority should be to settle your loan with the original lender and retrieve your gold. Until the contract is formally closed and you have the physical gold back, you cannot legally sell it to another party. Some professional gold buyers can help you with the loan repayment process to streamline the transaction.

FAQs

1. Will I always get the market rate for pledged gold?

Not always. Many people expect the “spot price” but learn that jewelry pieces include making charges, stones, and sometimes non-gold parts. Buyers usually pay only for the pure gold weight and purity, which means the amount you receive is often less than what you paid originally.

2. How much below market (spot) can I expect from a buyer?

It depends on who you sell to and how many grams. Smaller local shops or pawn brokers often give less (sometimes 5–15% below spot) because they have overheads, take risks, or need to refine or resell the gold. Bigger dealers or refineries may offer rates closer to spot, especially if your piece is large and in good condition.

3. What happens if my gold has stones, or is broken or mixed metals?

4. Should I trust online quotes and platforms?

You can use them for comparison, but be cautious:

- Some quotes may exclude shipping, insurance, or verification charges.

- Reviews and reputation matter.

- When shipping gold, there’s risk; ensure the platform insures shipments.

- Check exactly how purity and weight will be verified once the item arrives.

5. How can I protect myself from being cheated?

Here are tips frequently shared:

- Ask the buyer to show their testing equipment (XRF or acid test) and perform the test in front of you.

- Get multiple quotes. Don’t accept the first offer.

- Ask for transparent rate sheets (how much per gram, how much they deduct, any service charges).

- Keep all documents: pledge receipts, hallmarks, bills. These help in valuation and avoid disputes.

6. What is melting / scrap value? How is it different?

Melting (scrap) value is what your gold piece is worth purely as raw gold (after purity is determined), ignoring design, stones, and craftsmanship. Jewelry often sells for less than scrap value if heavily decorated or mixed with non-gold metals, because the buyer has to remove non-gold, refine it, then resell. People frequently realize this only after they get offers.

7. How fast will I get payment after selling?

Reputed buyers often give payment immediately after verification. If online, there might be wait time for shipment, purity confirmation, or some internal checks. In any case, a trustworthy buyer will explain when you’ll get paid (same day / next day / after verification).

FAQs

1. Will I always get the market rate for pledged gold?

Not always. Many people expect the “spot price” but learn that jewelry pieces include making charges, stones, and sometimes non-gold parts. Buyers usually pay only for the pure gold weight and purity, which means the amount you receive is often less than what you paid originally.

2. How much below market (spot) can I expect from a buyer?

It depends on who you sell to and how many grams. Smaller local shops or pawn brokers often give less (sometimes 5–15% below spot) because they have overheads, take risks, or need to refine or resell the gold. Bigger dealers or refineries may offer rates closer to spot, especially if your piece is large and in good condition.

3. What happens if my gold has stones, or is broken or mixed metals?

Pieces with stones, mixed metals, or damage are often priced lower. Stones may be removed or valued separately. Mixed metals reduce purity. Broken pieces might be melted down. Always ask the buyer: “How will you treat stones or non-gold parts?” This affects what you get paid.

4. Should I trust online quotes and platforms?

You can use them for comparison, but be cautious:

- Some quotes may exclude shipping, insurance, or verification charges.

- Reviews and reputation matter.

- When shipping gold, there’s risk; ensure the platform insures shipments.

- Check exactly how purity and weight will be verified once the item arrives.

5. How can I protect myself from being cheated?

Here are tips frequently shared:

- Ask the buyer to show their testing equipment (XRF or acid test) and perform the test in front of you.

- Get multiple quotes. Don’t accept the first offer.

- Ask for transparent rate sheets (how much per gram, how much they deduct, any service charges).

- Keep all documents: pledge receipts, hallmarks, bills. These help in valuation and avoid disputes.

6. What is melting / scrap value? How is it different?

Melting (scrap) value is what your gold piece is worth purely as raw gold (after purity is determined), ignoring design, stones, and craftsmanship. Jewelry often sells for less than scrap value if heavily decorated or mixed with non-gold metals, because the buyer has to remove non-gold, refine it, then resell. People frequently realize this only after they get offers.

7. How fast will I get payment after selling?

Reputed buyers often give payment immediately after verification. If online, there might be wait time for shipment, purity confirmation, or some internal checks. In any case, a trustworthy buyer will explain when you’ll get paid (same day / next day / after verification).

Final Thoughts & Next Step

Selling pledged gold may seem complicated at first, especially with paperwork, loan clearance, and the worry of getting undervalued. But once you know the process, it becomes much easier to handle. The most important step is to choose the right type of buyer—someone who is transparent, licensed, and customer-focused. This ensures you don’t face hidden charges, unclear testing, or delays in payment.

When you look at the Best Places to Sell Your Pledged Gold in Bangalore, a few options clearly stand out. Trusted local jewellers can be helpful for smaller amounts, while reputed professional buyers like IMG Gold Buyers specialize in releasing pledged gold and offering instant settlements at fair market rates. If you’re dealing with larger quantities, authorized bullion dealers are also a reliable choice, as they typically offer close-to-market values.

By comparing a few offers, asking the right questions, and making sure the buyer tests purity in front of you, you’ll not only get the best possible value but also enjoy peace of mind knowing your transaction is safe and legitimate.

Written by LIjo James