-

By LIjo James

-

October 31, 2025

- 0 Comment

How to Sell Old Gold Safely and Smartly — A Complete Seller’s Guide

LIjo James

Lijo James – Internal Auditor & Gold Appraiser With over 10 years of experience, Lijo James is a seasoned Internal Auditor and Gold Appraiser specializing in the gold market. His expertise lies in conducting detailed gold market studies, ensuring accurate appraisals, and implementing robust auditing practices. Lijo’s in-depth knowledge of gold trends and market dynamics enables him to deliver reliable insights and maintain high standards of financial accountability. Dedicated to precision and integrity, he consistently ensures compliance with industry regulations while optimizing processes. His commitment to excellence makes him a trusted professional in the gold appraisal and auditing sector.

Read full bio of LIjo JamesIt’s a familiar moment — you’re decluttering, open an old jewellery box, and find a tangled chain, a dented bangle, or earrings you haven’t worn in years. Instantly, the thought pops up: “Should I sell this and make some extra cash?”

That’s when the real questions begin:

- How can I be sure I’m getting a fair price?

- Which gold buyer can I truly trust?

- Is it better to sell to a jeweler, an online platform, or a professional gold-buying company?

Selling old gold may seem straightforward, but a fair deal depends on much more than just weight. Purity, daily gold rates, timing, and hidden deductions can all impact your final payout. With the right knowledge, you can walk away confident — without losing value to guesswork or unclear pricing.

Understand What You’re Selling - Jewelry vs Scrap

Not all “old gold” is created equal. A 22K necklace isn’t the same as a broken 18K ring. Treat designer jewellery differently from scrap. You might get more selling it as jewellery instead of for melt value. Buyers evaluate based on a few key points:

- Purity / Karat: 24K is pure gold, but most jewellery is 18K or 22K. Higher karat = higher melt value.

- Weight: Gold is priced per gram, so every decimal matters. Always ask to see the digital scale.

- Gemstones or Designer Value: If your piece has diamonds or is from a well-known brand, mention it — it may raise the value.

- Current Gold Rate: Always check the day’s gold rate before visiting any buyer. This sets your expectation range.

The Main Ways to Sell Old Gold

Different people want different things — some want instant cash, others prefer the best rate possible. Here are your main options:

(a) Local Jeweller or Gold Buyer

Pros: You get an instant evaluation and can receive payment immediately, making it convenient for quick transactions.

Cons: Offers are often slightly below market value because the buyer needs to cover refining and resale costs.

Best for: Sellers who prefer a fast, face-to-face process and immediate cash, especially when dealing with trusted gold buyers in Hyderabad who follow transparent testing and valuation practices.

(b) Online / Mail-in Gold Buyers

Pros: These buyers have a wider reach, allowing you to compare multiple offers and potentially get a better price.

Cons: You won’t be present during testing, and the payout may take longer due to shipping and verification.

Best for: Sellers who are comfortable with technology and value convenience over instant payment.

(c) Reselling as Jewellery (Private Sale)

Pros: You can earn a higher price if your piece has designer, vintage, or brand value beyond just the gold content.

Cons: The process takes more time and effort, and you need to find the right buyer willing to pay a premium.

Best for: Owners of vintage, antique, or branded jewellery looking to maximize returns.

(d) Pawn Shops / Quick Cash Outlets

Pros: Provide immediate cash, making them useful in urgent financial situations.

Cons: Typically offer the lowest price compared to other selling options.

Best for: Sellers who need quick money and are willing to accept a lower payout as a short-term solution.

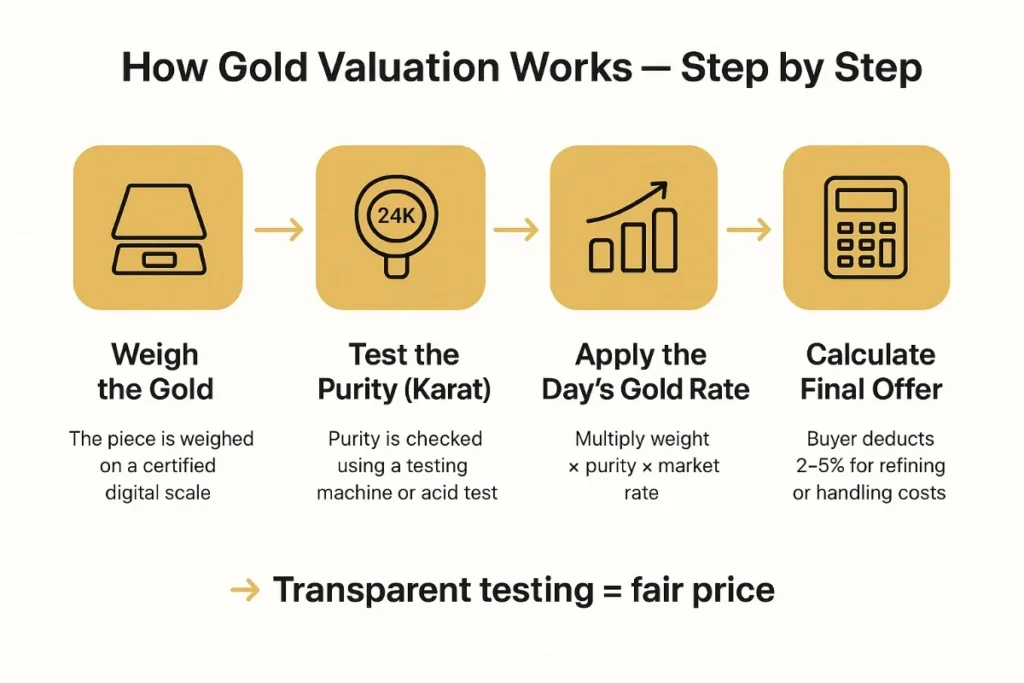

How Gold Valuation Really Works (Simplified Example)

Here’s what happens behind the counter when you sell your gold:

- Weighing: The piece is weighed in grams.

- Testing Purity: Buyers test for karat using electronic or acid testing.

- Rate Applied: They multiply weight × purity × current gold rate.

- Buyer Margin: A small margin (2–5%) is deducted for melting/refining.

This is why working with experienced second hand gold buyers can make a difference — they follow transparent testing processes that ensure every gram is fairly valued.

Smart Tips to Get the Best Price

Getting the most value for your old gold isn’t just luck — it’s about preparation and awareness. Here’s how to maximize your payout:

- Check today’s gold rate: Stay updated on market prices through trusted sources like LiveMint or MCX India to set realistic expectations.

- Compare multiple offers: Obtain at least three quotes — from a local jeweller, a professional gold buyer, and an online platform — to ensure you’re getting the best deal.

- Watch the testing process: Always be present when your gold is weighed and tested for purity; transparency prevents underpayment.

- Ask for written receipts: A proper invoice protects you from disputes and provides legal documentation of the transaction.

- Don’t rush decisions: Gold rates fluctuate daily, so if possible, wait for a favorable moment rather than accepting the first offer.

- Know your purity: Check for hallmarks or BIS stamps, which verify karat and guarantee your gold’s authenticity, helping you claim its true value.

These steps ensure you sell confidently, safely, and profitably, avoiding common pitfalls that cost sellers money.

Regional Insights: How It Works in India (and Beyond)

- India: Gold buyers in India typically calculate offers based on the daily market rate set by local associations, which helps standardize pricing across the region. This ensures that sellers receive a fair value aligned with current gold trends.

- Jewellery Exchange: Many jewellers allow you to exchange old jewellery for new pieces rather than providing cash. This can be a convenient option if you’re planning to buy new jewellery soon, often giving slightly better value than scrap sale.

- Verification & Charges: Always check for hallmarks or BIS stamps to confirm purity before selling. Additionally, ask whether the buyer charges for melting or testing, as these fees can reduce your final payout.

- Abroad: When selling gold outside India, many countries require valid ID verification for legal compliance. Payments are usually made via bank transfer instead of cash, ensuring secure transactions and record-keeping.

FAQs — Real Questions from Gold Sellers

Should I sell my gold to a pawn shop?

Many Reddit users advise against selling gold to pawn shops due to low offers. One user mentioned: “Pawn shops will pay you 70%-80% of the value.” reddit.com

How can I get the best price when selling gold?

It’s recommended to call multiple buyers before visiting in person. One Redditor shared, “First thing to know is you should not just walk in to a gold shop and ask for a price, call a few businesses first and ask what they offer” reddit.com.

Does the type of gold affect the selling price?

Yes. The type and condition of the gold directly affect the selling price.

For example, if you have 10k gold weighing around 11.6 grams, and the calculated value based on the day’s gold rate comes to approximately ₹40,000–₹42,000, most buyers may offer 20–30% less. This reduction accounts for purity, resale costs, and refining losses.

Is selling gold online a good option?

Selling gold fully online is usually not the best option.

Genuine online gold buyers are still very rare in India, and many platforms lack transparency in pricing and purity checks.

There are higher risks involved, such as undervaluation, delayed payments, or disputes after pickup.

A safer alternative is booking an online pickup with a trusted offline buyer like IMG Gold Buyers, where purity is tested transparently and payment is made instantly.

This gives you the convenience of online booking with the safety and fair pricing of a physical gold buyer.

Conclusion: Get the Value You Deserve

Selling old gold doesn’t have to be stressful or uncertain. The key is being informed — understanding the purity of your gold, keeping track of live market rates, and asking the right questions puts you firmly in control of the process. A transparent transaction ensures you receive the best possible value without hidden deductions or surprises.

If you want a transparent, quick, and trustworthy evaluation, consider visiting IMG Gold Buyers — where every piece of gold is tested openly in front of you, rates are updated in real time, and payments are made instantly, giving you a safe, fast, and trustworthy selling experience. Knowledge, transparency, and fair evaluation together ensure that you get the value your gold truly deserves.

Written by LIjo James