-

By LIjo James

-

December 27, 2025

- 0 Comment

How Gold Selling Became Part of Women’s Financial Independence

LIjo James

Lijo James – Internal Auditor & Gold Appraiser With over 10 years of experience, Lijo James is a seasoned Internal Auditor and Gold Appraiser specializing in the gold market. His expertise lies in conducting detailed gold market studies, ensuring accurate appraisals, and implementing robust auditing practices. Lijo’s in-depth knowledge of gold trends and market dynamics enables him to deliver reliable insights and maintain high standards of financial accountability. Dedicated to precision and integrity, he consistently ensures compliance with industry regulations while optimizing processes. His commitment to excellence makes him a trusted professional in the gold appraisal and auditing sector.

Read full bio of LIjo JamesFor generations, gold has been part of a woman’s life long before she understood money. It arrived as bangles at birth, jewellery at weddings, and small gifts during milestones. Traditionally, it symbolised beauty, status, and family legacy. But quietly, and steadily, gold also became something else. A form of financial security that women could rely on when life demanded it.

Today, selling gold is no longer seen only as a last resort. For many women, it has become a conscious, practical choice. One that supports independence, decision-making, and control during crucial moments.

Gold as a Quiet Safety Net for Women

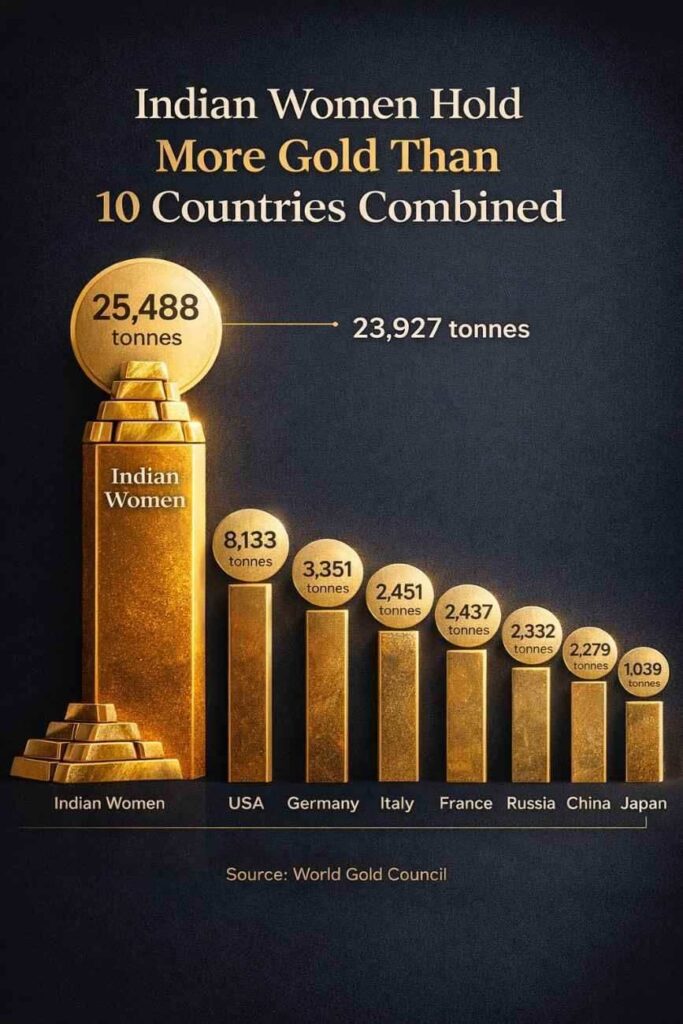

In India and across many cultures, gold given to women has always carried a deeper meaning. It was never just ornamentation. It was protection.

This concept is deeply rooted in traditions such as streedhan, where gold was gifted to women to ensure they had something of their own. Something liquid. Something accessible. Something that did not depend on permissions, paperwork, or prolonged explanations.

A recent academic study on Indian women’s investment behaviour explains this clearly:

“Gold continues to function as a safe-haven asset for women, offering liquidity, security, and autonomy during periods of economic uncertainty.”

— Gold as a Safe Haven: Analyzing the Investment Patterns of Indian Women ResearchGate Study

This safety net mattered even more in times when women had limited access to formal banking, property ownership, or credit systems.

Why Gold Feels Like a Personal Investment for Women

Unlike other financial assets, gold is tangible. It is held, worn, and safeguarded personally. For many women, this creates a sense of ownership that is both emotional and practical.

Gold allows women to:

- Hold value independently

- Access funds discreetly

- Act quickly during emergencies

- Retain control without long-term financial obligations

This is why gold has often been the first asset considered during medical emergencies, education expenses, or family crises. Not because of tradition alone, but because it works.

From Ornament to Asset. A Shift in Perspective

As financial awareness has grown, so has the way women view gold. The emotional connection remains, but the understanding has evolved.

Women today increasingly recognise that:

- Gold holds long-term value

- It protects against inflation

- It can be converted into cash without debt

- It provides flexibility that loans often do not

An insightful personal reflection published by Sharesight captures this shift beautifully. The author describes how gold jewellery functioned as an emergency fund long before formal savings became accessible:

“Bestowing gold is the equivalent of providing women with an emergency fund. If you’re in a situation that you need to get out of, you have your gold jewellery. It can be quickly exchanged for money.”

— My investment portfolio used to be gold bangles Sharesight Article

This perspective explains why gold selling is not a sign of loss. It is the use of an asset exactly as intended.

When Selling Gold Becomes a Smart Financial Decision

There are moments in life where speed, clarity, and control matter more than sentiment.

Women often choose to sell gold when:

- Medical expenses arise unexpectedly

- Children’s education fees need immediate funding

- A business or self-employment opportunity appears

- Household finances need short-term stability

- They want to avoid debt or long-term repayment stress

In these moments, gold provides liquidity without future burden. There are no EMIs. No interest. No dependency.

Gold Selling vs Borrowing. Why Many Women Choose the Former

Borrowing money often comes with conditions. Paperwork, approvals, repayment anxiety, and long-term stress. Selling gold, on the other hand, offers immediate relief.

This is why many women prefer selling gold instead of taking loans:

- No future financial obligation

- No accumulation of interest

- Complete control over the decision

- Clear closure once the transaction is done

Gold selling, when done transparently, becomes a debt-free financial solution.

Trust Matters More Than Price

- Clear purity testing

- Transparent calculations

- Respectful handling of jewellery

- Privacy and professionalism

- Instant and fair payment

Selling Gold Today. Support, Not Stigma

Despite changing times, selling gold is still surrounded by silence. Many women hesitate, not because they doubt the value of gold, but because of outdated perceptions.

The reality is different. Selling gold today represents:

- Financial awareness

- Responsible decision-making

- Confidence in using one’s assets

- Independence during critical moments

Gold continues to support women. Sometimes worn proudly. Sometimes stored carefully. And sometimes sold wisely.

A Quiet Form of Financial Confidence

Financial independence does not always come through loud milestones. Sometimes, it exists quietly in the assurance that help is available when needed.

Gold provides that assurance. Even when untouched, it offers peace of mind. And when sold thoughtfully, it offers stability.

Conclusion. Gold as Strength, Not Just Ornament

Gold has always stood beside women. Across generations, across cultures, across changing economic realities.

Today, it stands not only as tradition, but as choice. A choice that allows women to act, decide, and move forward with confidence.

Selling gold is not about letting go. It is about using strength that was always there.

Thinking of selling gold?

Sources referenced for credibility and authority

FAQs

Is selling gold a good alternative to taking a loan?

Yes. Selling gold offers instant liquidity without EMIs or interest, making it a debt-free option compared to personal or gold loans during urgent situations.

How is gold purity checked before selling?

Gold purity is tested using non-destructive methods such as XRF machines. The process is done in front of the customer and the results are explained clearly before valuation.

Can women sell gold independently without family approval?

Yes. Women can sell gold they own independently. The transaction is legal, confidential, and does not require consent from family members.

Is it safe to sell inherited or wedding jewellery?

Yes, as long as the jewellery is legally owned. Professional gold buyers evaluate purity and weight transparently, regardless of whether the gold is inherited or gifted.

Written by LIjo James