-

By LIjo James

-

December 28, 2025

- 0 Comment

The Process of Evaluating Old Gold: How Buyers Determine Its Value

LIjo James

Lijo James – Internal Auditor & Gold Appraiser With over 10 years of experience, Lijo James is a seasoned Internal Auditor and Gold Appraiser specializing in the gold market. His expertise lies in conducting detailed gold market studies, ensuring accurate appraisals, and implementing robust auditing practices. Lijo’s in-depth knowledge of gold trends and market dynamics enables him to deliver reliable insights and maintain high standards of financial accountability. Dedicated to precision and integrity, he consistently ensures compliance with industry regulations while optimizing processes. His commitment to excellence makes him a trusted professional in the gold appraisal and auditing sector.

Read full bio of LIjo JamesWhen you walk into a gold buying centre with old jewellery, the process can feel quiet and unfamiliar. Your gold is examined, weighed, tested, and calculated. Within minutes, a value is quoted.

For many sellers, the question remains. How was this number arrived at?

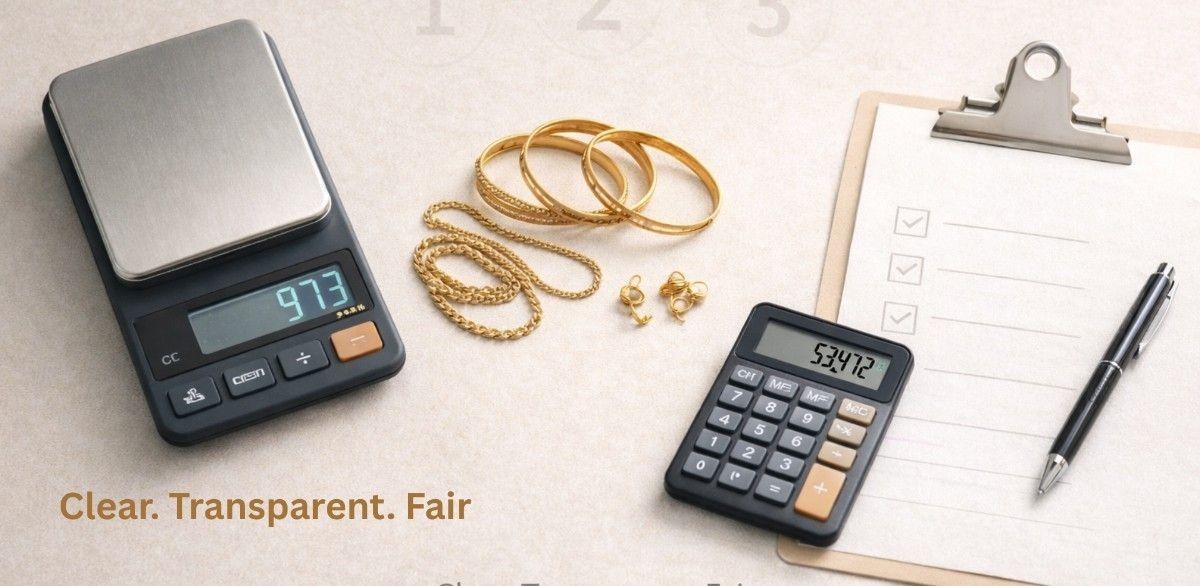

Gold valuation is not a rough estimate or a subjective decision. Reputable gold buyers follow a defined, step-by-step evaluation process designed to determine the actual recoverable gold value in an item. Understanding this process helps sellers feel confident and recognise transparency when they see it.

This blog explains how buyers evaluate old gold, from their side of the counter.

Why Old Gold Is Evaluated Differently from New Jewellery

Old gold is valued very differently from new jewellery purchased at a showroom.

When jewellery is bought new, the price includes:

- Gold value

- Making charges

- Design and craftsmanship costs

- Brand premiums

When old gold is sold, buyers focus on one thing only.

How much pure gold can be recovered from the item.

Design, age, and wear do not increase the value during resale. The evaluation is based purely on metal content, not appearance.

Step 1: Identifying What Is Actually Gold

The first thing buyers assess is what portion of the item is genuinely gold.

Old jewellery often contains:

- Clasps made from mixed metals

- Soldered joints with lower purity alloys

- Embedded stones or decorative elements

Buyers carefully separate or account for these components because only the gold portion can be valued. This step is essential to avoid over- or under-valuation and ensures the calculation reflects the true metal content.

Step 2: Measuring Weight Accurately

- Stones and attachments are excluded from the gold weight

- Only the metal portion is weighed

- Precision electronic scales are used

Step 3: Testing Purity Using Non-Destructive Methods

- 22K gold (approximately 91.6 percent purity)

- 18K gold (approximately 75 percent purity)

- 14K and lower karats in some items

Step 4: Calculating Recoverable Gold Content

This is the core calculation step.

Buyers determine how much pure gold exists within the item by combining:

- Net weight

- Purity percentage

For example:

- An item weighing 10 grams at 22K purity does not contain 10 grams of pure gold

- It contains approximately 9.16 grams of pure gold

This calculation explains why two pieces that look similar can receive different valuations. Internal soldering, past repairs, and alloy composition all affect the recoverable gold content.

Step 5: Applying the Live Gold Rate

Once the pure gold content is calculated, buyers apply the current market rate for pure gold.

This rate:

- Is linked to international gold prices

- Changes daily, sometimes multiple times a day

- Is applied to 24K gold value and adjusted based on purity

It is important to understand that jewellery showroom prices are not used for old gold valuation. Buyers use live market rates relevant to gold recovery and refining.

Step 6: Final Valuation and Offer

After calculating the recoverable gold value, buyers arrive at the final offer.

This amount may reflect:

- Refining and processing considerations

- Operational costs involved in recovery

A professional gold buyer explains how the final figure is derived and gives the seller time to decide. Transparency at this stage is a key indicator of fair practice.

Why Different Buyers May Quote Different Prices

Sellers often notice variations in quotes across buyers. This usually happens due to differences in:

- Accuracy of purity testing

- Precision in weighing

- Frequency of rate updates

- Transparency in calculation

The highest quote is not always the fairest one. A clear explanation of how the value was calculated often matters more than a marginally higher number.

What Happens to Your Gold at IMG Gold Buyers in Bangalore

Step 1: Initial Inspection

Your gold is visually checked to identify purity markings and separate any non-gold components such as stones or mixed metals before testing begins.

Step 2: Non-Destructive Purity Testing

Purity is tested using advanced XRF technology, without scratching or melting the gold, and the results are shown to you in real time.

Step 3: Net Weight Measurement

Only the actual gold content is weighed using calibrated digital scales, excluding stones, beads, or attachments.

Step 4: Gold Value Calculation

The recoverable gold value is calculated using the verified purity percentage and net weight of the gold.

Step 5: Live Market Rate Application

The current live gold rate is applied based on market prices at the time of evaluation, ensuring fair and up-to-date valuation.

Step 6: Transparent Final Offer

The final amount is explained clearly, with no hidden deductions, allowing you to make an informed decision without pressure.

Step 7: Instant Payment

Once confirmed, payment is processed immediately with proper documentation and KYC compliance.

Each step is designed to ensure transparency, accuracy, and confidence, so you know exactly how your gold is evaluated and priced.

What Sellers Can Do to Ensure Optimal Value for Old Gold

While buyers control the evaluation process, sellers can still protect their interests by focusing on clarity rather than negotiation.

Sellers should:

- Choose buyers who test purity in front of you

- Ask how net gold weight is calculated

- Understand that stones and alloys affect value

- Compare evaluation transparency, not just the final price

When the process is explained clearly, sellers can make informed decisions without pressure.

What Sellers Can Do to Ensure Optimal Value for Old Gold

While buyers control the evaluation process, sellers can still protect their interests by focusing on clarity rather than negotiation.

Sellers should:

- Choose buyers who test purity in front of you

- Ask how net gold weight is calculated

- Understand that stones and alloys affect value

- Compare evaluation transparency, not just the final price

When the process is explained clearly, sellers can make informed decisions without pressure.

Why Transparency Is the Real Indicator of Fair Valuation

Gold valuation is a technical process, but trust comes from visibility.

Transparent buyers:

- Conduct testing openly

- Use precise weighing methods

- Explain each step calmly

- Allow sellers to decide without urgency

This approach builds confidence and ensures the valuation reflects the true worth of the gold.

Conclusion: Gold Valuation Is a Process, Not a Guess

Evaluating old gold is not based on assumptions or rough estimates. It follows a structured process designed to identify purity, measure weight accurately, calculate recoverable gold, and apply live market rates.

Understanding how buyers determine value allows sellers to recognise fairness when they see it. When the process is transparent, selling old gold becomes a confident, informed decision rather than an uncertain one.

If you want to know the true value of your old gold, choose a buyer who explains the process clearly before you decide.

FAQs

How do gold buyers determine the value of old gold?

Gold buyers calculate value based on three core factors. Purity of the gold, net weight after removing non-gold elements, and the current market price of gold.

Is the design or appearance of jewellery considered during valuation?

No. When selling old gold, buyers evaluate only the recoverable gold content. Design, brand, or visual condition do not increase resale value.

How is gold purity checked during evaluation?

Reputed gold buyers use non-destructive XRF testing to determine purity accurately. This method does not damage the jewellery and provides instant results.

Are gemstones included in the gold value?

No. Stones, beads, and other attachments are excluded from the gold weight. They are either removed or deducted during calculation.

Written by LIjo James