-

By LIjo James

-

November 4, 2025

- 0 Comment

Gold Prices Dip After Festive Rush — What It Means for Buyers and Sellers in Kerala

LIjo James

Lijo James – Internal Auditor & Gold Appraiser With over 10 years of experience, Lijo James is a seasoned Internal Auditor and Gold Appraiser specializing in the gold market. His expertise lies in conducting detailed gold market studies, ensuring accurate appraisals, and implementing robust auditing practices. Lijo’s in-depth knowledge of gold trends and market dynamics enables him to deliver reliable insights and maintain high standards of financial accountability. Dedicated to precision and integrity, he consistently ensures compliance with industry regulations while optimizing processes. His commitment to excellence makes him a trusted professional in the gold appraisal and auditing sector.

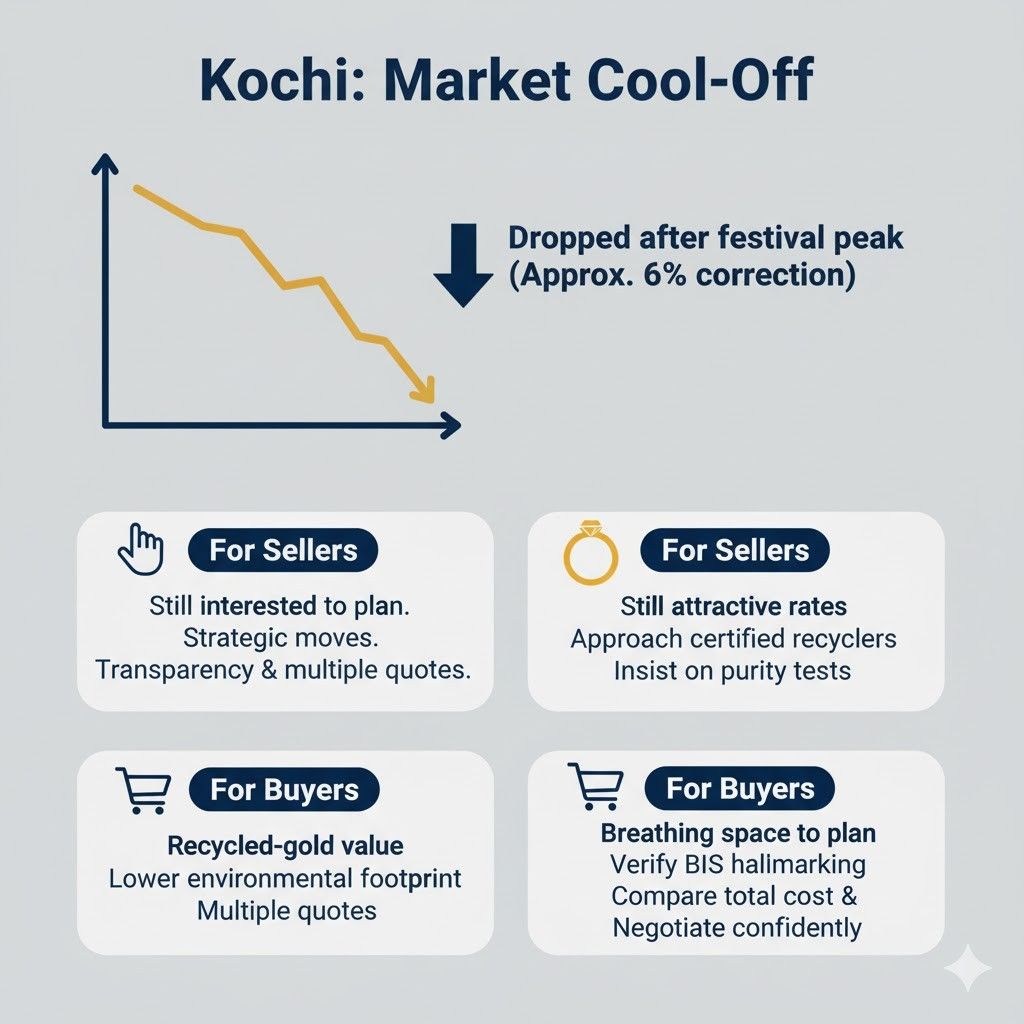

Read full bio of LIjo JamesKochi: Gold Market Sees Post-Festival Cool-Off

After setting record highs in October, gold prices in India have fallen by nearly ₹10,000 per 10 grams, cooling enthusiasm among retail buyers.

According to Moneycontrol, domestic prices dropped from around ₹132,294 per 10 g to approximately ₹122,700 as of late October, reflecting a 6 percent correction from peak levels.

Analysts attribute the pull-back to fading festival demand, global profit-taking and easing safe-haven buying.

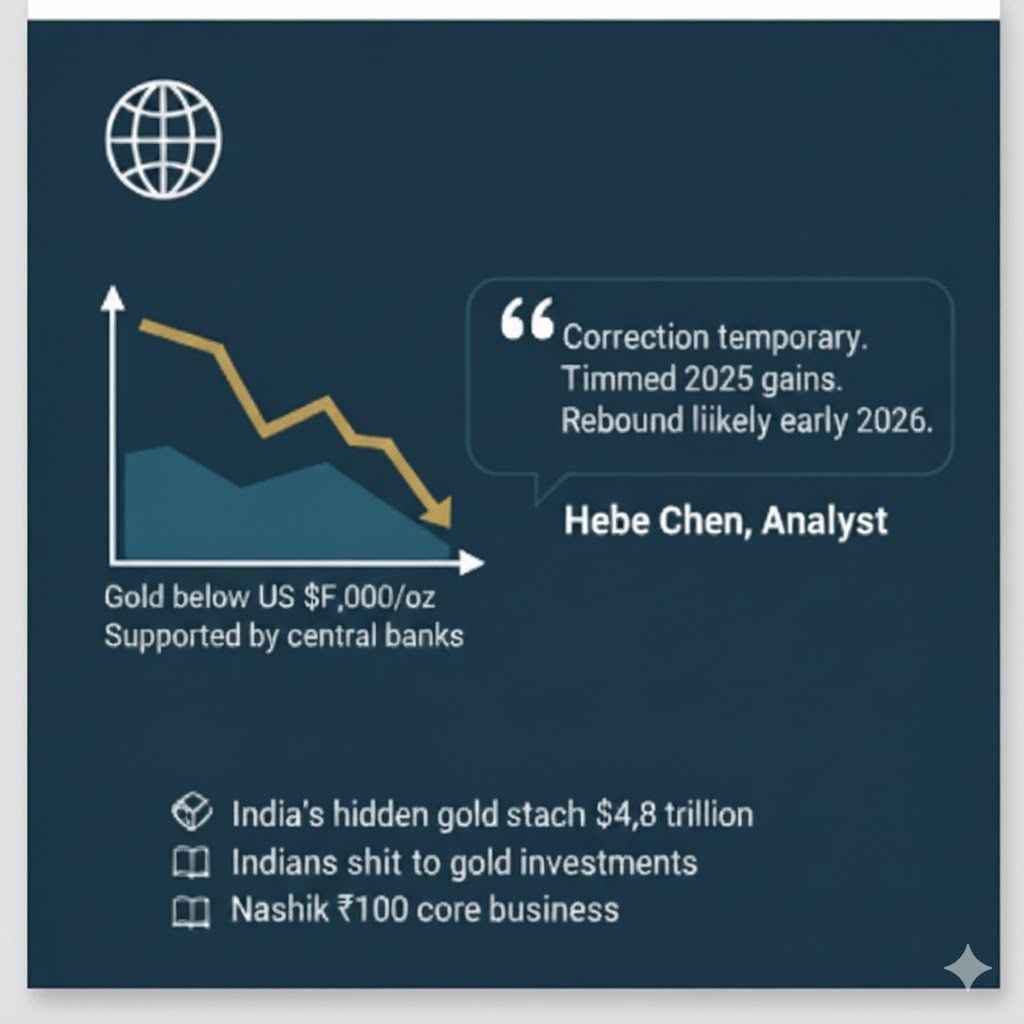

“After an overstretched rally, gold is undergoing a healthy correction,” said Hebe Chen, analyst at Vantage Global Prime. “Prices are consolidating before the next move.”

Why Prices Are Falling

- Technical pull-back: After months of rapid price increases, gold is undergoing a natural correction as the market stabilizes. This helps prevent overheating and sets the stage for more sustainable movement ahead.

- Festive slowdown: Following major festivals like Dhanteras and Diwali, demand for gold jewelry typically drops as buyers take a pause after heavy festive purchases.

- Stronger dollar: When the U.S. dollar strengthens and interest-rate expectations shift, global investors tend to move away from gold, reducing its price.

- Profit-booking: Many investors have started selling their holdings to secure profits from the recent record highs, creating short-term downward pressure on gold prices.

Despite the short-term dip, investment appetite remains robust.

The World Gold Council reported India’s gold investment demand topped US $10 billion in the September 2025 quarter, even as jewelry sales eased.

What It Means for Sellers

- Attractive rates: Even though prices have dipped slightly, gold still holds high value historically, allowing sellers to earn good returns on old jewelry.

- Certified recyclers: Always choose licensed or certified gold recyclers who provide proper purity testing to ensure your gold is evaluated fairly.

- Transparency and multiple quotes: Get price estimates from multiple buyers and choose the one with clear, open procedures to avoid undervaluation and secure a fair deal.

In Kerala, this phase often encourages households to liquidate unused or old jewellery through trusted second-hand gold buyers in Kerala, especially when prices remain historically strong despite short-term corrections.

What It Means for Buyers

- Softer market: With gold prices easing after the festive rush, gold buyers have more time and flexibility to plan purchases without feeling pressured by soaring rates.

- Recycled-gold jewelry: Buying jewelry made from recycled gold is often more affordable and eco-friendly, helping buyers get better value while supporting sustainable practices.

- Verification and comparison: Always check for BIS hallmarking or IGDS certification to ensure purity, compare the total cost including making charges and taxes, and don’t hesitate to negotiate for a fair price.

Global Context

Globally, gold prices have retreated from their record highs as traders and investors closely watch the U.S. Federal Reserve’s next move on interest rates. When the Fed signals potential rate hikes or maintains higher rates for longer, it strengthens the U.S. dollar and makes non-yielding assets like gold less attractive, leading to a short-term price drop.

In the spot market, gold has slipped below the US $4,000 per ounce mark, reducing part of its impressive 60% year-to-date gains in 2025, as investors take profits and adjust their positions.

However, long-term fundamentals remain strong — central banks worldwide continue to buy gold to diversify reserves, and safe-haven demand persists amid global economic uncertainty and geopolitical tensions. These factors are expected to keep gold prices supported even after temporary corrections.

Expert Outlook

Most market experts believe the current drop in gold prices is only a short-term correction after an extended rally. If global inflation remains high and economic growth slows, investors are likely to return to gold as a safe asset, potentially driving prices back up by early 2026.

In the meantime, gold buyers and sellers in Kerala can take advantage of this calmer phase to make smarter choices — focusing on value, proper certification, and recycling rather than rushing into speculative trades.

Related Reads

Related Reads

Bottom Line

Kerala’s gold market is deeply rooted in tradition, with both long-established family jewelers and modern recyclers playing key roles in maintaining trust and transparency. The recent price dip isn’t a setback but rather a healthy pause that allows both buyers and sellers to reassess their strategies and make informed decisions. Those who stay aware of market trends, prioritize certified and sustainable gold options, and act thoughtfully now will likely benefit the most when prices rise again.

Written by LIjo James